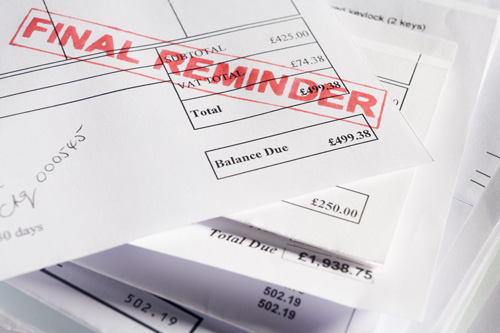

Overdue Invoices

Are you sitting on invoices that should have been paid? Perhaps your in-house resources are struggling to chase them all? Well, you’re not the only one…

Although many large firms have some financial reserves to cope with late invoices, it doesn’t make good business sense to have admin and finance teams tied-up with chasing bad or late debts.

Any delay after agreed payment terms have been missed, puts the squeeze on a company’s cash flow, impacting operating costs including wages, re-investment and ultimately the bottom line profit.

Even the Government has admitted that late payment legislation “hasn’t worked” and European directives that make the standard invoice payment term of 30 days compulsory for all businesses are simply flouted unless planned and effective credit control systems are in place.